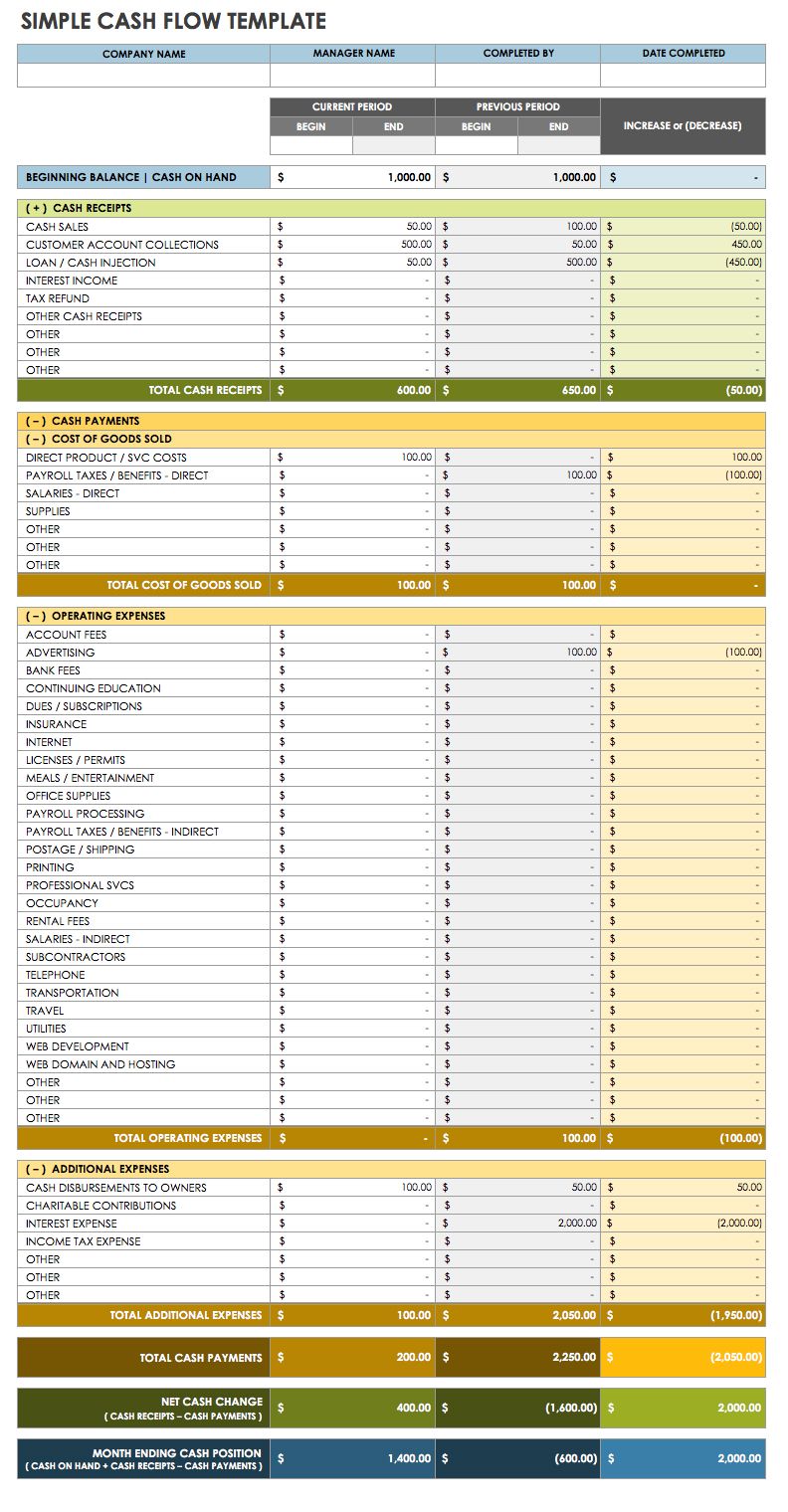

The first method used to calculate the operation section is called the direct method, which is based on the transactional information that impacted cash during the period. Now that you understand what comprises a cash flow statement and why it’s important for financial analysis, here’s a look at two common methods used to calculate and prepare the operating activities section of cash flow statements.

It’s important to note that cash flow is different from profit, which is why a cash flow statement is often interpreted together with other financial documents, such as a balance sheet and income statement. Ideally, a company’s cash from operating income should routinely exceed its net income, because a positive cash flow speaks to a company’s ability to remain solvent and grow its operations. Financing activities detail cash flow from both debt and equity financing.īased on the cash flow statement, you can see how much cash different types of activities generate, then make business decisions based on your analysis of financial statements.

Cashflow online free#

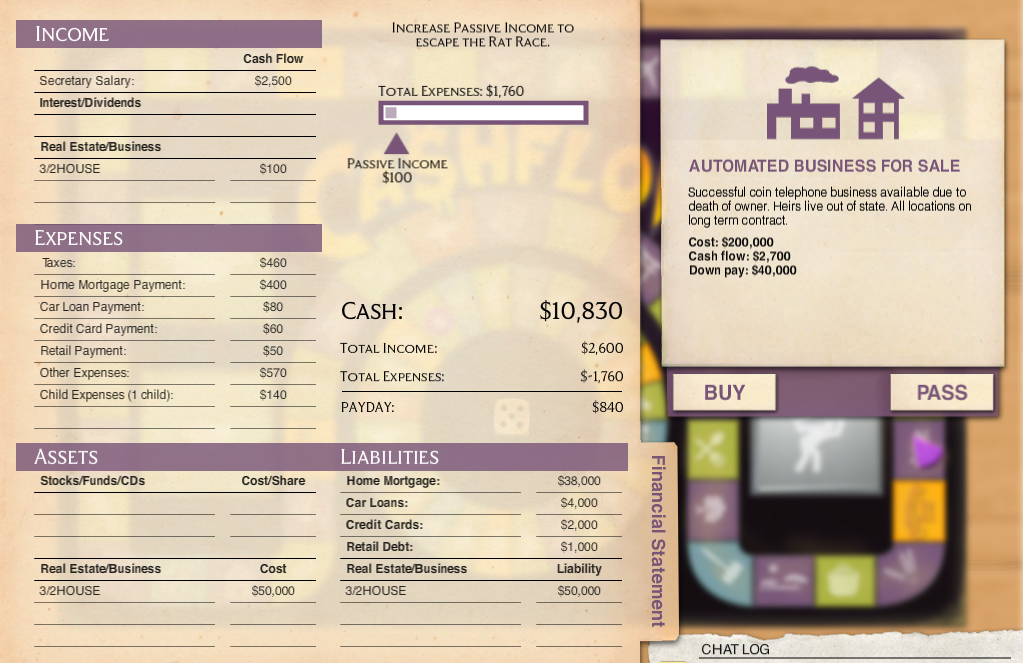

Investing activities include cash flow from purchasing or selling assets-think physical property, such as real estate or vehicles, and non-physical property, like patents-using free cash, not debt. Operating activities detail cash flow that’s generated once the company delivers its regular goods or services, and includes both revenue and expenses. The cash flow statement is typically broken into three sections:

It demonstrates an organization’s ability to operate in the short and long term, based on how much cash is flowing into and out of the business. The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash during a specified period, known as the accounting period.

Cashflow online how to#

To facilitate this understanding, here’s everything you need to know about how to read and understand a cash flow statement.įree E-Book: A Manager's Guide to Finance & AccountingĪccess your free e-book today.

For non-finance professionals, understanding the concepts behind a cash flow statement and other financial documents can be challenging. Not everyone has finance or accounting expertise. If you’re a manager, it can help you more effectively manage budgets, oversee your team, and develop closer relationships with leadership-ultimately allowing you to play a larger role within your organization. If you’re a business owner or entrepreneur, it can help you understand business performance and adjust key initiatives or strategies. If you’re an investor, this information can help you better understand whether you should invest in a company. Andrew understands entrepreneurs because he is an entrepreneur, having started several businesses of his own and has authored two books on small business.Whether you’re a working professional, business owner, entrepreneur, or investor, knowing how to read and understand a cash flow statement can enable you to extract important data about the financial health of a company.

As an internationally recognized small business expert, he has trained entrepreneurs in Canada and 21 other countries. ModeratorĪndrew Patricio is the founder and owner of Bizlaunch, a company that trains, advises and mentors entrepreneurs. Participants will be encouraged to ask questions, share resources and knowledge and to learn from other business owners. In this interactive session, you will meet with subject matter experts to learn their best practices and the key points they believe business owners should focus on, including: Subject: Cash Flow, Financials Session Overview About this eventĪll webinar participants will also receive access to a recording and any resource materials after the live session. Let's discuss the importance of cash flow to your organization.

0 kommentar(er)

0 kommentar(er)